SMM News on June 16:

On June 10, the Ministry of Ecology and Environment of the People's Republic of China publicly issued the "Notice on Regulating Matters Related to the Import of Recycled Black Mass Raw Materials for Lithium-ion Batteries and Recycled Steel", with the document index number 000014672/2025-00219. The notice disclosed the HS code for recycled black mass raw materials for lithium-ion batteries as 3824999996, and the announcement will be implemented from August 1, 2025.

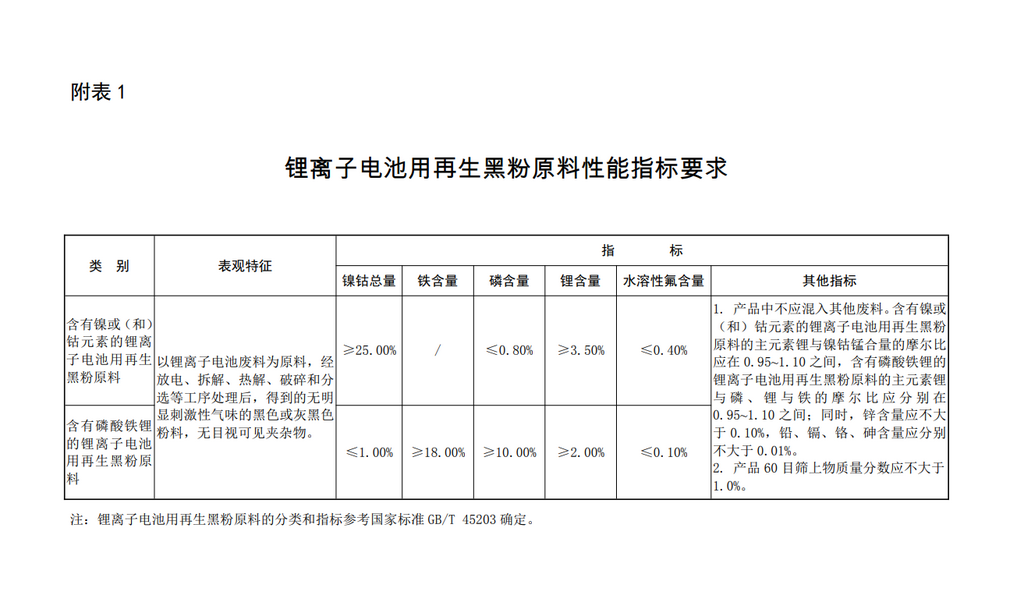

I. Specific Standards for Import and Export of Black Mass

The announcement states that recycled black mass raw materials for lithium-ion batteries that meet the table's criteria are not classified as solid waste and can be freely imported. Additionally, recycled black mass raw materials cannot be mixed with other categories of recycled raw materials, and different types of recycled raw materials cannot be declared under the same customs declaration form during customs clearance.

The import and export standards for battery black mass in this document are consistent with those in the "Recycled Black Mass for Lithium-ion Batteries" document, which was issued on December 31, 2024, and is expected to be implemented on July 1, 2025, with the standard number GB/T 45203-2024. This document was issued by the State Administration for Market Regulation and the Standardization Administration of the People's Republic of China. The document classifies recycled black mass for lithium-ion batteries into Category I, Category II, Grade 1, and Grade 2, corresponding to ternary battery black mass, ternary pole piece black mass, LFP pole piece black mass, and LFP battery black mass, respectively. Therefore, it is expected that after the liberalization, these types of black mass that meet the standards will be freely imported and exported.

II. Overview of China's Lithium-ion Battery Black Mass Market

Currently, China accounts for at least 70% of the global lithium battery recycling capacity, with sufficient capacities for dismantling, grinding, and hydrometallurgy recycling. Moreover, due to the tight supply in the lithium battery recycling sector, the main pricing power remains concentrated in the hands of upstream sellers. Therefore, it is expected that after the official liberalization of black mass import and export, China will become an importer of lithium-ion black mass. Currently, with the continuous decline in the prices of most salt products and the sustained losses of grinding mills and hydrometallurgy plants, most hydrometallurgy enterprises have chosen to reduce the frequency of external purchases and are in a semi-shutdown state. As of June 16, 2025, the nickel-cobalt coefficient for ternary pole piece black mass is 73-75%, and the lithium coefficient is 70-73%. The nickel-cobalt coefficient for ternary battery black mass is 70-72%, and the lithium coefficient is 68-70%. The lithium price per % for LFP pole piece black mass is 2,200-2,350 yuan/mtu, and for LFP battery black mass, it is 2,000-2,150 yuan/mtu.

III. Overview of Overseas Lithium-ion Battery Black Mass Market

Japan and South Korea also have production lines for dismantling, grinding, and hydrometallurgy recycling. However, due to the limited quantity of local production waste and end-of-life batteries, the overall scale is relatively limited. Local ternary black mass also uses coefficients, and prices are mainly settled based on overseas refined nickel and refined cobalt prices.

In Europe and North America, the local market is dominated by ternary, low-nickel ternary, and some consumer batteries, with some grinding and dismantling layouts, as well as wet-process layouts in the pilot stage in laboratories. However, in October 2024, the European Commission revised the qualitative list for handling scrap lithium batteries and waste in Europe, classifying black mass and alkaline scrap batteries as hazardous materials. Following the revision, products such as black mass from lithium-ion batteries and scrap lithium-ion batteries will be prohibited from being exported to non-OECD countries, including Southeast Asia and China. Previously, most black mass from Europe was transported to Japan and South Korea, Southeast Asia, and other regions for front-end pretreatment before being traded locally. The coefficient for black mass traded in Southeast Asia, such as ternary black mass, is also priced with reference to overseas metal nickel and refined cobalt, with some enterprises also pricing it with reference to lithium carbonate on domestic website platforms.

After the official opening of black mass imports and exports, it is expected that the US, Southeast Asia, and other regions will become major exporters of ternary black mass. The local pricing system for black mass, especially ternary black mass, is relatively mature for three reasons. First, ternary black mass contains three metals, making it inherently valuable and highly market-focused. Second, overseas retired vehicles are mainly ternary, so ternary scrap accounts for a relatively high proportion in the scrap market. Third, overseas lithium ore is already at a low cost, and lithium carbonate prices remain low, making it relatively uneconomical to recover LFP black mass for lithium extraction in the short term. The pricing system for overseas LFP black mass is less mature compared to ternary black mass.

IV. Challenges Faced

In the regenerated black mass for lithium-ion batteries, two categories of indicators specifically indicate the water-soluble fluorine content: ≤0.1% and ≤0.4%, respectively. The fluorine content mainly comes from one of the four main materials of lithium-ion batteries—the solute LiPF6 in the electrolyte. Fluorine ions are prone to corrode equipment, affect salt extraction yield, and cause serious environmental pollution. Previously, overseas progress in handling scrap lithium batteries was slow in the wet-process treatment stage due to research on how to handle fluorine-containing wastewater and waste gas. The current fluorine content standards are relatively high for battery black mass, and overseas-processed black mass cannot fully meet import and export standards.

Meanwhile, although North America, Southeast Asia, Japan, South Korea, and other regions have black mass available for external circulation and export, China's local recycling capacity at various stages is severely surplus and has been operating at a loss for a long time. Exporting black mass to China can alleviate supply tightness but cannot immediately fully restore the profits of grinding and wet-process plants. Only as enterprises gradually exit the market, a large-scale retirement wave slowly approaches, the market restores supply-demand balance, and recycling enterprises' profits can gradually recover.

SMM believes that the release of this standard provides strong support for expanding the channels for key recycling raw materials such as black mass from domestic lithium-ion batteries in the future. After most hydrometallurgy recycling enterprises received the draft for public comments, which is expected to be released in H2, within March 2025, their attention to overseas lithium battery black mass traders has further increased. At this stage, multiple enterprises intend to cooperate with overseas traders to import local black mass after the formal relaxation of import and export regulations.

SMM New Energy Research Team

Cong Wang 021-51666838

Rui Ma 021-51595780

Disheng Feng 021-51666714

Yanlin Lv 021-20707875

Zhicheng Zhou 021-51666711